Technology

Green Zip Technology is a Movable and Removable Partition System that transforms non-load bearing drywall. The patented process allows for the installation of drywall such that they can be removed, relocated and reused, in both new construction and renovation.

ARCHITECT Magazines states “It’s hard to get simpler in conception and execution than Green Zip”

Working in conjunction with the IRS has allowed Green Zip® to provide significant financial benefits and increased cash flow for investors in commercial and residential rental real estate.

Green Zip® Tape is Fire Rated *

Green Zip® is the only drywall tape to pass IRS testing to qualify for Federal Tax benefit

How to Install

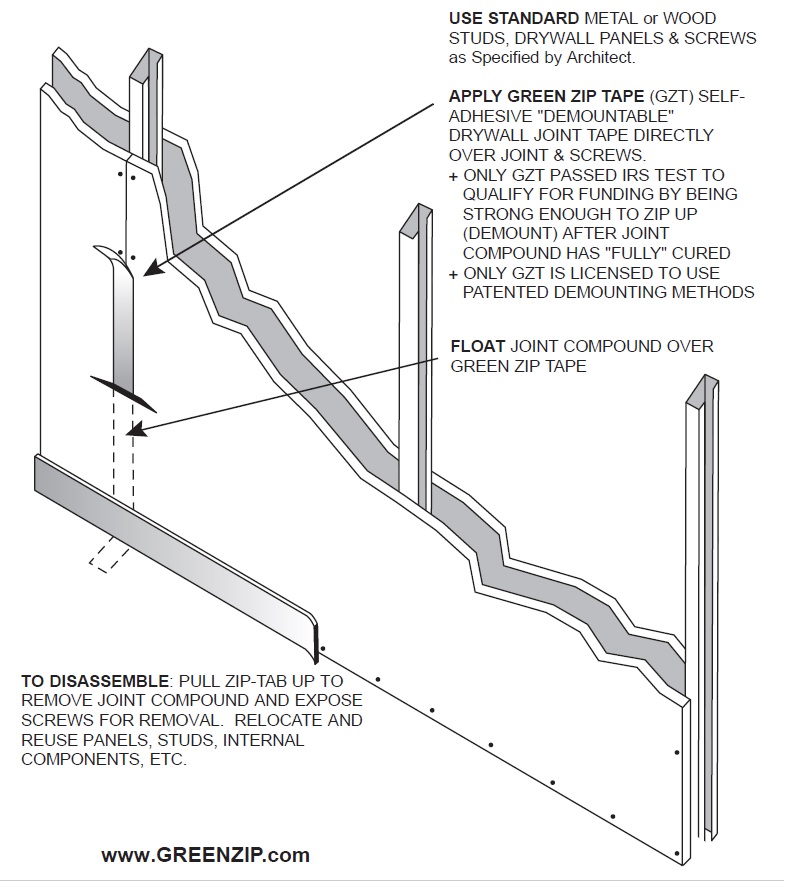

- Walls are installed using conventional materials – gypsum board, removable screws and joint compound.

- Instead of mudding over the screws and drywall joints, the self-adhesive Green Zip® Tape is applied first.

- Joint compound is then applied over the patented Green Zip® joint Tape which was developed with precise horizontal and vertical super-fiber threads to control the amount of compound applied in the mudding process.

- A tab is left exposed at the joint bottom, later covered by baseboard or carpet.

- To remove and reuse the drywall partition1, this tab is exposed and the super-fiber strength allows the tape to be “zipped up” through the mud and paint to cleanly expose the seam and drywall screws for demounting.

INSTALLATION

- Attach drywall to metal or wood studs with removable screws

- Instead of mudding over the screws and drywall joints, the self-adhesive Green Zip® Tape is applied first

- Float the finish coat of mud compound over the Green Zip Tape

DEMOUNTING

- Pull tape up through the mud and paint to expose the screws beneath

- Remove the screws with a power drill

- Remove the drywall panels and stack on cart for reuse

1 Method for removing Joint Tape and Drywall is protected by US Patents including #10,648,153, #2,643,293 CA, #7197853,#7197853, #7451577B2 and US & Foreign Pending Patents © 2009 Green Zip. All rights reserved *The Green Zip Tape in our warehouse is UL classified. It was manufactured/produced prior to our withdrawal from the UL program and met UL requirements at that time.

Improve Construction Costs

Conventional gypsum drywall, removable screws and metal or wood studs are used with the self-adhesive Green Zip Tape. Drywall panels may be installed using Green Zip tape vertically or horizontally to non-load bearing partitions not located at the perimeter, elevators or building cores. Green Zip won’t add to the construction schedule or construction cost.

Green Zip® technology speeds the time of drywall installation.It provides a means to comply with local landfill diversion and green building requirements. Reducing project related landfill costs, time, and transportation. It also provides a hedge against future ever-increasing landfill and waste costs and restrictions banning drywall. When drywall is deposited in a landfill it combines with moisture and organic matter to create poison H2S gas, as a consequence the EPA has designated it hazardous waste.

Green Zip® tape is backed with a strong adhesive, eliminating the need for a mud base coat over seams

Using our Zip Stick®, in conjunction with a flat box mud applicator, speeds the taping process. In a Marek Brothers test, GreenZip was twice as fast as a “Bazooka” type applicator and required fewer and less-skilled finishers.

Our Zip Stick® applicator weighs about 4 pounds, compared to a “Bazooka” type drywall applicator that can weigh as much as 18 pounds (fully loaded with joint compound or “mud”)

Zip Stick® requires no maintenance. A “Bazooka” type drywall applicator must be cleaned and oiled regularly.

Green Zip can be installed on both metal and wood stud frames using removable screws.

Green Zip reusable drywall partitions can reduce your remodel cost.

Since 2008, Clark Contractors has successfully brought GreenZip benefits to its clients, including Embassy Suites, Bank OZK, and more.

In 2013, Turner Construction an international construction firm known for embracing new technologies documented a retrofitting case study for British Petroleum BP that substantiates and endorses the product’s. effectiveness. Turner estimated that the cost savings achieved with Green Zip® amounted to $110 per linear foot when a wall is relocated.

In 2021, HITT Contracting funded a field test and study of the GreenZip Partition System. The favorable report resulted in HITT recommending GreenZip to its clients.

You don’t need to use hot mud or quick setting mud or any type of chemically drying joint compound. Just float normal, high quality joint compound over the Green Zip® Tape.

When retrofitting interior space for tenant requirements, reusable Green Zip® drywall partitions can reduce costs:

- Provides a means to comply with local landfill diversion and green building requirements

- Reduces project related landfill costs, time, and transportation

- Provides a hedge against future, ever-increasing landfill tipping and waste costs and ever-increasing landfill restrictions that band drywall altogether

- Avoid noisy, dusty demolition saws and sledgehammers, reducing demo costs, time and the potential for demo-related accidents

- Allows “quiet” remodel work during normal business hours (not just nights & weekends when labor is more expensive) without disturbing adjacent occupants

- Allows re-use of materials already on-site, further reducing time and costs. A reduction in retrofitting time can also reduce labor costs and employee or tenant downtime during a remodel

- Allows access to internal parts of the building to assist in building system repairs or mold mitigation

Tax Advantage

The IRS has ruled that moveable and removable GreenZip Partitions classify as personal property. This qualifies them for shorter life depreciation than conventionally installed drywalls — 5 years, or less, as opposed to 27.5 years for residential rental property or 39 years for commercial buildings. Installation of removable drywall partitions using the patented Green Zip® technology – in both new construction and renovation projects – has, since 2008, provided commercial real estate investors with improved cash flow and lower remodel costs.

The same financial benefits (accelerated depreciation) can be applied to renovation projects. Once used, Green Zip® can help reduce the cost of future renovations.

In 2010, Chevron installed 88 floors of GreenZip and two years later relocated the GreenZip Partitions on 18 of those floors. Also, In 2013, Turner Construction (an international construction firm known for embracing new technologies) documented a retrofitting case study for British Petroleum that substantiates and endorses the projects effectiveness. Turner estimated that the cost savings achieved with Green Zip® amounted to $110 per linear foot when a wall is relocated. Green Zip is a dream come true for tenant and facility managers.

In February of 2014, Price Waterhouse Coopers (PWC) highlighted the IRS accelerated depreciation classification ruling (regarding our patented technology) on their website and featured it in their monthly Accounting Methods Spotlight. That same year, in an article published in Bloomberg BNA Daily Tax Report, David Burton, a tax attorney and partner at Akin Gump Strauss Hauer & Feld, affirmed the IRS ruling. And, after a year long vetting process, RSM (formerly McGladrey) issued a ringing endorsement in 2015 and used Green Zip on its Dallas office expansion.

Any commercial or residential rental property constructed or purchased after 1986 qualify for the federal tax benefits. Green Zip been approved by the IRS as Asset Class 57.0 personal property. Refer to IRS Private Letter Ruling PLR 110197-13, buildings that fall within Business Activity Asset Class 57.0 – Distributive Trades and Services. Asset Class 57.0 includes commercial building assets used in wholesale and retail trade and personal and professional services; this encompasses office buildings, hotels, motels, medical office facilities, hospitals, assisted living, and any professional services buildings, such as banks, small businesses, and wholesale/ retail merchants and more.

Refer to 2018 letter from Huffman, a developer of apartments and hotels with a decade of Green Zip use, when subject to a routine IRS audit that passed muster with IRS without any GreenZip questions or adjustments. Green Zip has never triggered an audit.

Green Zip® technology can reduce investors’ near-term tax liability and increase cash flow. For example, say a residential rental building costs $50 Million to build — and $5 million of that is considered “personal” property (i.e not part of the permanent building structure). The tax paying investor is able to depreciate that $5 million of expense on the property over five4 years. The rest of the building cost — $45 million — depreciates over 27.5 years, providing a much slower tax deduction savings (i.e. a slower rate of return).

Now take that same example — and using Green Zip® — say an additional $10 million in construction expense can now be reclassified as “personal” property. The tax paying investor is now able to depreciate $15 million of expenses on the property over five4 years. On an after-tax basis (assuming a 39% tax rate), the accelerated depreciation on that additional $10 million in expenses would amount to a savings of $3.9 million over 5 years. In other words, the investor reduced near-term tax liability — and thus increased cash flow — by $3.9 million over the five-year4 period. This highlights the powerful benefit of installing walls with Green Zip® and utilizing a Cost Segregation study to properly classify assets in accordance with IRS guidelines.

There is an additional financial benefit to installing Green Zip® drywall partitions. When the building is sold, the new owner can claim the total amount of the accelerated depreciation identified in the cost segregation study. This amount (recalculated on the basis of the property’s new purchase price) still includes the demountable drywall partitions and the elements on, in, and behind them. This gives the building additional value and may provide the seller with a competitive advantage.

4 The Tax Cuts and Jobs Act allows more rapid depreciation and thus greater benefit.

Apartment buildings and assisted living facilities also qualify for these tax benefits.The U.S. Senate, the author and superior authority of our tax law, succinctly clarified the tax law in Senate Report #95 stating, “a movable and removable partition is tangible personal property and not a structural component.” The issue turns exclusively on is it “movable and removable” with no restrictions as to what type of building contains the movable and removable partitions. Also, IRS Private Letter Ruling PLR 110197-13 specifically addresses our zip-type demountable drywall partitions referencing Senate Report #95 as support for its personal property classification. Refer to letter from Huffman, a developer of apartments and hotels with a decade of Green Zip use, when subject to a 2018 routine IRS audit that passed muster with IRS without any GreenZip questions or adjustments. Also reference the letter from Americare Assisted Living with over a decade of employing Green Zip in its projects.

Only Green Zip® Tape is recognized by the IRS to allow for the accelerated depreciation associated with the potential demounting and reuse of gypsum drywall. In a 2008 video audit conducted by the IRS, Green Zip® Tape was the only drywall joint tape out of 20 plus competitive brands that performed to IRS specifications and allowed the drywall joints to be “unzipped,” successfully exposing the seam and drywall screws. There is no other way to get these added tax benefits other than using our patented process and tape.

You don’t ever have to move the walls to qualify for the tax benefit; The U.S. Senate, the author and superior authority of our tax law, succinctly clarified the tax law in Senate Report #95 stating, “a movable and removable partition is tangible personal property and not a structural component.” The issue turns exclusively on is it “movable and removable” with no restrictions as to having to move the partitions. Also, IRS Private Letter Ruling PLR 110197-13 specifically addresses our zip type demountable drywall partitions referencing Senate Report #95 as support for its personal property classification.

Under US Tax laws and accounting rules, a cost segregation analysis identifies and reclassifies personal property assets from real property assets to shorten their depreciation time for tax reporting purposes; this reduces current income tax obligations. A cost segregation study is needed to determine the value of the assets, including demountable drywall partitions, which can be treated as personal property under the federal tax code and depreciated over a five-year period as opposed to 27.5 years for residential rental property or 39 years for commercial buildings.

Green Zip® is the only drywall tape that will successfully remove mud compound after it has cured to full hardness. This was demonstrated for – and captured on video by – senior IRS attorneys to get their validation and acceptance of the product and to prove that our patented construction method qualifies for a reclassification of assets. It is the only brand of drywall tape that passed the IRS test; the other drywall tapes failed to meet the IRS requirements necessary to treat drywall as personal property for the monetary incentives.

In 2008 a Fortune 100 company funded a IRS Pre-File Audit study that validated GreenZip as personal property. In 2014, the IRS issued Private Letter Ruling PLR 110197-13 confirming the accelerated depreciation classification for removable walls installed with Green Zip® technology. In 2018, Huffman, a developer of apartments and hotels with a decade of Green Zip use, was the subject of a routine IRS audit that passed muster with IRS without any GreenZip questions or adjustments. Also reference the letter from Americare Assisted Living with over a decade of employing Green Zip in its projects, and Turner Construction vetted the process in a cost savings case study done for British Petroleum. Awards given by the EPA and the AIA all further validate the product claims. Green Zip® simply combines innovative architecture with cost segregation accounting practices and is considered brilliant by those who understand both of these aspects.

The Green Zip product has NEVER caused an audit. We have fortune 100 companies with full time IRS auditors that have used our product and supported the depreciation during their normal audit. We have also had companies pay to have a pre-file audit that was completely affirmed by the IRS and we have a pre-file private letter ruling [ PLR 110197-13 ] that supports all of our claims. The DOJ (Attorney General, Janet Reno) worked with the founder to give this benefit to businesses to encourage the only environmentally sustainable solution for keeping drywall out of landfills. The IRS isn’t trying to stop this – they approved the design of the benefit!

The construction method creates a loss that can be carried forward and used in future years—and or carried back. There is great cash flow value in still getting the benefit earlier than you normally would even if you have to delay a year or two. It can also increase the sales value of the property. There are strategies to sell the tax benefit to a party or parties that can use the tax benefit.

Buildings constructed with our technology can increase resale values and provide the seller with a competitive market advantage. The new owner will again be able to claim the total amount of the accelerated depreciation identified in the cost segregation study, including the demountable drywall partitions, recalculated against the property’s new purchase price.

The ordinary income tax rate is higher than the long-term capital gains rate, thus creating benefit even after the sale by reducing income at a higher tax rate and recapturing it at a lower rate. Also, the construction method can provide an increased sales price of a building in that the new owner can also benefit from the moveable walls and the same accelerated depreciation and cash flow. Contact CSSI for more Green Zip details.

While CPA’s are great at what they do, there can still be some things that are outside of their areas of expertise. It is not realistic to expect them to be experts in the details of construction for example. We’ve occasionally found that reclassification of assets through the use of our Green Zip System sometimes falls into an area that they don’t understand well enough to be comfortable. Combine that with the fact that they may not want to bring in another accountant or competitor who does understand it well and you can get some initial hesitation or resistance. CSSI is the largest and oldest cost segregation firm in the country, we consult with CPAs an a daily basis and are happy to speak with your CPA about the benefits that your property qualifies for.